|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Filing Bankruptcy in Arizona: A Comprehensive Guide

Filing for bankruptcy can be a daunting process, especially when you're unsure of the specifics related to your state. In Arizona, understanding the types of bankruptcy, the process, and the implications is crucial. This guide will walk you through the essentials of filing bankruptcy in Arizona.

Understanding the Types of Bankruptcy

In Arizona, individuals typically file for either Chapter 7 or Chapter 13 bankruptcy. Each type serves different purposes and has distinct requirements.

Chapter 7 Bankruptcy

Known as 'liquidation bankruptcy,' Chapter 7 allows you to discharge most unsecured debts. This type of bankruptcy is suited for individuals with limited income.

Chapter 13 Bankruptcy

Chapter 13, also known as 'reorganization bankruptcy,' is ideal for those with a regular income who can repay some debts over time. It involves creating a repayment plan to pay back creditors over a period of 3 to 5 years. To estimate your payments, you can use a chapter 13 bankruptcy payment calculator.

The Bankruptcy Filing Process in Arizona

The process of filing for bankruptcy in Arizona involves several steps that must be followed meticulously.

- Credit Counseling: Before filing, individuals must complete a credit counseling course from an approved agency.

- Filing the Petition: The next step involves submitting a petition and other necessary documents to the bankruptcy court.

- Meeting of Creditors: Approximately 30 days after filing, a meeting with creditors will be held to discuss the case.

- Debt Repayment or Discharge: For Chapter 13, a repayment plan is established; for Chapter 7, eligible debts are discharged.

For a detailed understanding of the steps involved, you might consider reviewing the chapter 13 bankruptcy process.

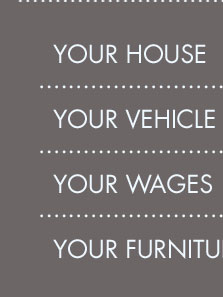

Exemptions and Protections

Arizona offers specific exemptions to protect certain assets during bankruptcy.

- Homestead Exemption: Protects equity in your home up to a certain limit.

- Vehicle Exemption: Allows you to protect equity in your vehicle up to a specified amount.

- Personal Property: Covers items like furniture, clothing, and tools of trade.

Understanding these exemptions can help preserve your essential assets during the bankruptcy process.

Frequently Asked Questions

What debts can be discharged in Chapter 7 bankruptcy in Arizona?

In Chapter 7 bankruptcy, most unsecured debts, such as credit card debt, medical bills, and personal loans, can be discharged. However, certain debts like student loans, child support, and tax obligations are generally not dischargeable.

How long does the bankruptcy process take in Arizona?

The duration of the bankruptcy process varies. Chapter 7 typically takes about 4 to 6 months from filing to discharge. Chapter 13 can last 3 to 5 years due to the repayment plan.

Can I keep my car if I file for bankruptcy in Arizona?

Yes, you can keep your car if you file for bankruptcy, provided the equity in your vehicle is within the state's exemption limit or if you can continue making payments under Chapter 13.

Also, the filing fee for a Chapter 7 bankruptcy in Arizona is $338. Therefore, unless you successfully apply for a waiver or to pay your fee in installments, ...

A bankruptcy case normally begins by the debtor filing a petition with the bankruptcy court. A petition may be filed by an individual, by a husband and wife ...

Once presented with the required forms and filing fee (if applicable), the bankruptcy court can then electronically open the case. Who can use eSR? Individuals ...

![]()